in 2023, sheep meat producers will be hoping for a less turbulent year than the last few have been.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

By 2024 Meat & Livestock Australia forecast the national sheep flock to be at 78.7 million head.

Producers need to be forewarned of what industry indicators to watch..

Analysts suggest five factors that will influence the industry this year.

La Nina continues

Agricultural market analyst, Matt Dalgleish points to the weather as one trend to follow.

"We are set to have three years in a row of wetter than normal weather, which has allowed the herd and flock rebuild to gather some good momentum," Mr Dalgliesh said.

The impact of La Nina has directed more moisture across the continent.

Analysis of the historic La Nina cycles since 1900 shows that there have only been three triple year La Nina events; 1954-1957, 1973-1976 and 1998-2001.

"So, the current wet cycle is likely to finish into 2023, as there has never been an incidence of four La Nina years in a row," Mr Dalgleish said.

Mr Dalgleish's company, Episode 3 (Ep3), looked at the average number of years seen between wet to dry seasons across the nation and over the last 120 years the average gap came in at around two years.

Employment issues

With a predicted sheep flock of over 78 million head, how will red meat processors cope with increased slaughter volumes given the lack of process workers and specialist boners/slaughterers?

MLA slaughter projections for 2024 for sheep/lamb slaughter sit at 30.2 million head - the highest slaughter volumes have been since 2019.

This represents 10 per cent more sheep and lamb than what was achieved in 2022.

During 2022, abattoirs reported capacity constraints due to labour shortages were impacting throughput levels.

The effects of Covid are also an ongoing issue.

Read More

US recession

"Higher flock levels mean increased red meat production available for export," Mr Dalgleish said.

"However, there are a few dark clouds on the horizon that could act as a reasonable headwind on beef and sheep meat export demand and flow through to weaker livestock prices into 2023."

According to Mr Dalgleish, one of the most reliable indicators of impending economic recession in the USA over the last four decades has been the yield curve between 10 year and two year US bonds.

More specifically, an inversion in the yield curve between these two financial instruments has preceded a recession in the US for five of the last six recessions since the 1980s.

The current strength of the yield curve inversion in the USA is the strongest it has been since the mid-1980s suggesting that a recessionary phase is likely to hit the US economy into 2023.

A faltering US economy has implications for the global economy and can impact upon key agricultural commodities that are susceptible to economic growth levels and consumer confidence, such as wool and sheep meat.

During 2022 and 2021 Australian lamb export volumes to the USA surged with average monthly volumes running 25 pc to 30pc above the five-year trend throughout much of the season.

China's Covid woes

Analysts at Rural Bank say ongoing impacts of China's Covid Zero policy is something to watch.

According to the Rural Bank's 2023 Australian Agriculture Outlook, of Australia's top ten lamb markets, the only one to decline in value in 2022 was China.

Mr Dalgleish agrees.

"These series of lockdowns have been hampering the Chinese economy, holding back Chinese consumer confidence and spending," he said.

"Over the first three quarters of 2022 the Chinese economy grew by just 3pc compared to the 5.5pc official target."

A Chinese economy under pressure into 2023 could pose some issues for Australia's sheep meat market

Live Export

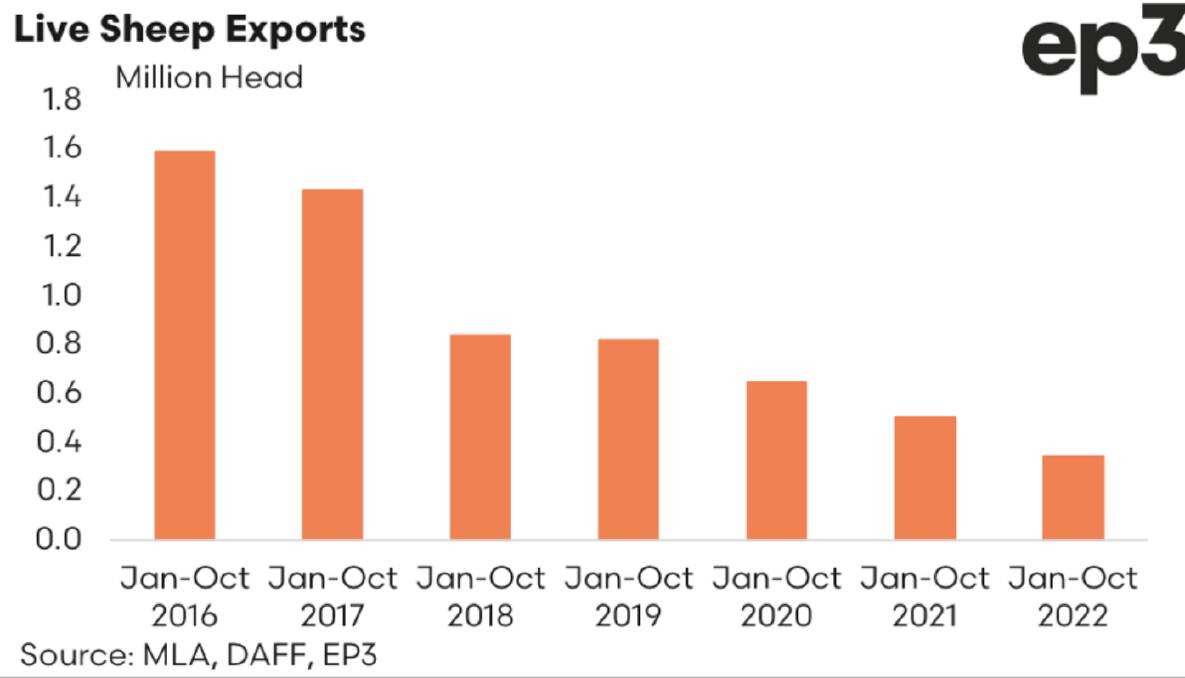

Analysis of the total live export flows from January to October 2022 shows that the sheep trade was underwhelming, running 32pc under the export levels recorded during this timeframe in 2021.

Annual live sheep export volumes are around one quarter of what they were five years ago.

"It was just a decade ago that the live sheep export industry was both an east coast and west coast affair," Mr Dalgleish said.

"In 2011, around 30pc of the live sheep export volumes exited the country from ports outside of Western Australia.

"However, since 2018 the trade has been predominantly a WA led industry, in terms of port of exit with at least 98pc of the annual live export turnoff of sheep leaving from the west."

During 2020 and 2021 there was an increased trade in live sheep from Western Australia to the eastern states with 1.9 million head of sheep and lamb making their way across the Nullarbor in 2020 and 0.7 million head in 2021, providing an alternative outlet for sheep turnoff instead of live export.

However, as of November, 2022, there has only been 0.3 million head of sheep transported east, leaving the domestic meat works in WA to pick up most of the turnoff, with slaughter volumes representing over 80pc of the sheep and lamb turnoff for WA by late 2022.

Meat works in WA have been no exception to the labour shortage issues facing the red meat processing sector.