ANY player in the animal protein game counting on calm and smooth waters ahead in the aftermath of the massive disruptions of the past two years will be disappointed, if not out of business.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

This is how most analysts and forecasters see the way ahead for the likes of beef, lamb, poultry, pork and seafood supply chains, including big agribusiness lender Rabobank.

The bank's Global Animal Protein Outlook 2022 says while the phenomenal levels of some markets may settle somewhat next year, many of the drivers of recent change will remain.

Higher input costs, logistical hurdles, forces driving more sustainable production, biosecurity challenges and the topsy-turvy nature of demand courtesy of pandemic upheavals won't disappear over the Christmas break, Rabobank and other animal protein experts believe.

"Against this backdrop, we expect animal protein prices to remain firm in 2022, supported by ongoing supply constraints and general strength in demand," the Rabobank report said.

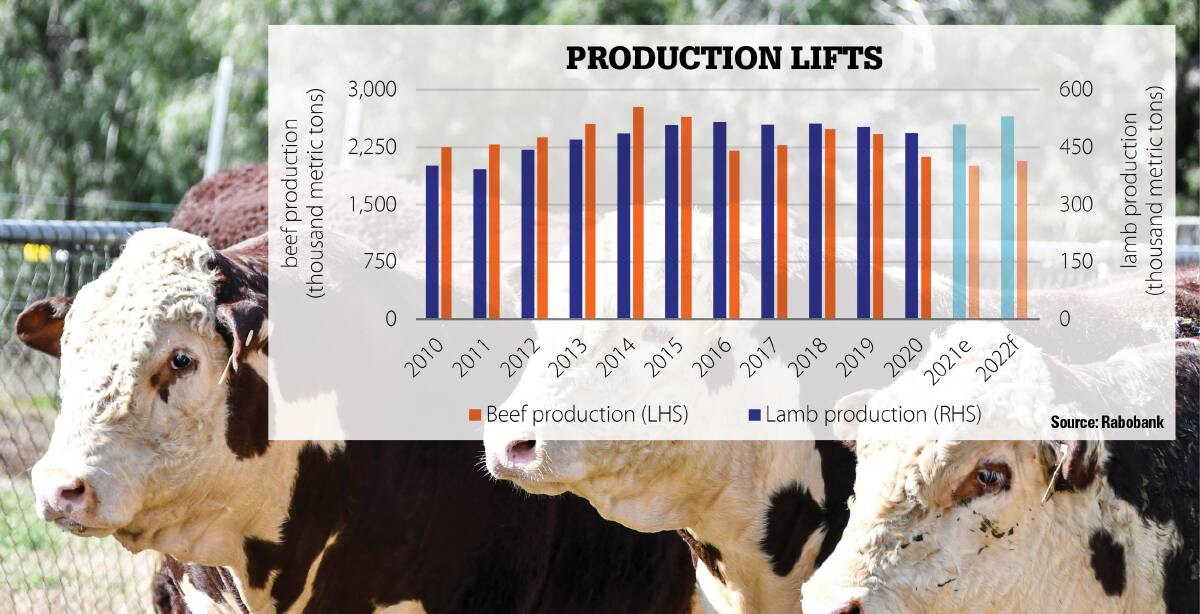

Australian beef and lamb production will start to lift in 2022 and while the fundamentals are strong, exporting will be far from smooth sailing.

ALSO READ:

The Rabobank report identified four key areas of cost inflation faced by animal protein supply chains at the moment - labour, animal feed, energy and freight.

Labour constraints are a global issue and are not going away anytime soon, the report said.

Worker availability was already an issue before COVID but the severity of the shortfall now was limiting production and slowing distribution.

While the temporary loss of labour to alternative financial support might be fading, staffing shortages in some regions and some sectors remained as high as 30 per cent, Rabobank's research has found.

Naturally, the situation is leading to raised wages but that is doing little to attract new labour to the industry. Double-digit wage hikes, meanwhile, will shift production costs.

Regions with better labour availability will have an advantage going forward, Rabobank found.

Australian analysts believe more consolidation in the beef processing sector is likely in 2022.

Thomas Elder Market analyst Matt Dalgleish said some consolidation occurred during 2021, including the country's largest processor, JBS, moving into other proteins.

During the drought years, the sector was well aware of the looming period of negative margins when herd rebuilding took off but the extent of the labour issue has been a curveball.

"We can't see any immediate relief for the processing sector in 2022 and based on historical relationships, extended periods of negative margins leads to consolidation," Mr Dalgleish said.

Rabobank's research shows the relative economics of automation are changing with structurally higher labour costs.

Companies were shifting budgets to fund additional investments in labour-saving technologies in 2022, which may slow other operational or strategic investments, it found.

Swine fever

African swine fever will remain a key influencer of global animal protein flows next year, Rabobank analysts believe.

While ASF outbreaks continued during 2021, China was recovering and pork production increased strongly, squeezing out poultry, the report said.

Rabobank global strategist for animal protein Justin Sherrard said the ongoing decline in China's pork imports would exacerbate the over-supply in Europe.

Beef consumption in China, however, is predicted to show resilience despite volatile pork and poultry prices, driven by a trend towards more premium product. Rabobank is forecasting China's beef imports to continue to increase in 2022.

Imports of premium beef cuts will likely grow the fastest, the report said.

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.