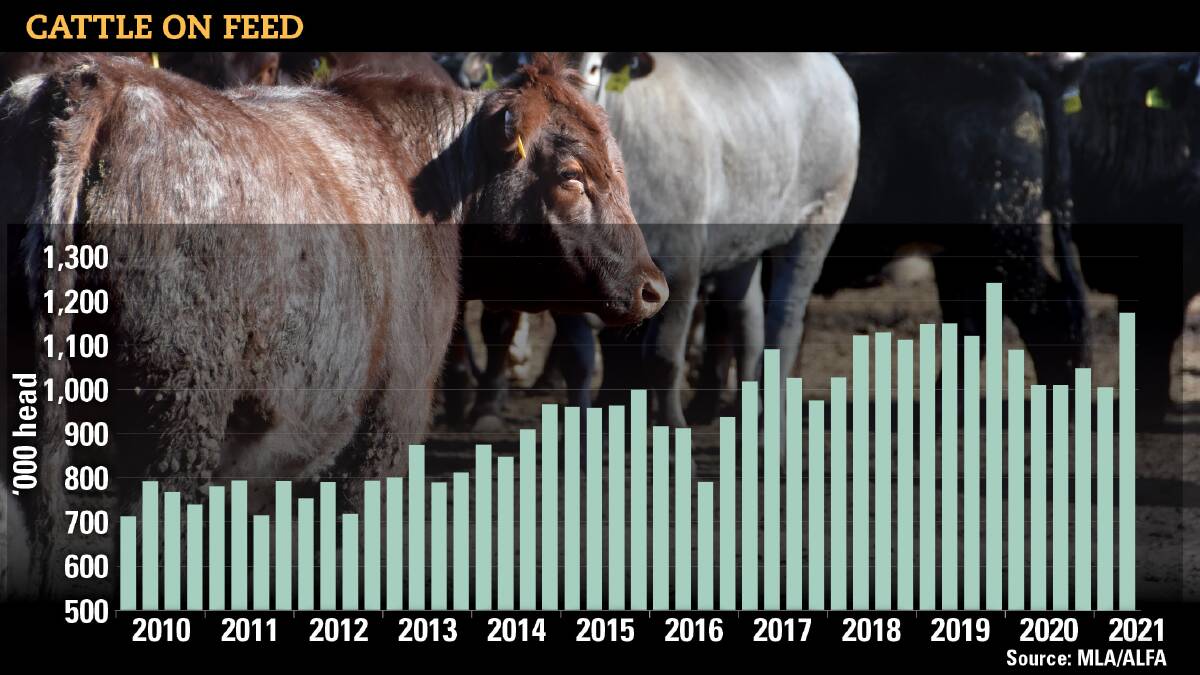

CATTLE on feed numbers continue to increase despite extremely tight supply and phenomenally high livestock prices, reflecting very strong demand for grain-fed beef globally and the role production certainty plays in commanding a premium.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Numbers on feed are now at levels above many of the drought quarters and nipping at the heels of the record high set in late 2019.

The latest industry survey shows numbers increased in the June quarter to sit at 1,173,652 head, which is 11 per cent higher than the five-year average and 16pc up on year-ago levels.

Queensland's numbers on feed jumped 30pc, while NSW's lifted by 4pc, Victoria by 12pc and South Australia by 1.3pc.

Western Australia was the only state to record a decrease in cattle numbers on feed, decreasing by 32.5pc, in line with seasonal trends.

ALSO READ:

Prices of all three of the key spokes in the lotfeeding game - cattle, grain and grain-fed beef - have risen significantly but the fact that lot feeders continue to take a growing percentage of young cattle on offer indicates margins have not shifted dramatically.

Meat & Livestock Australia analyst Stuart Bull reported the National Feeder Steer Indicator remains in record territory. It averaged 442 cents a kilogram live weight in the June quarter, an increase of 1.8pc on the previous quarter and is 28pc up on year-ago levels.

At the same time, the Queensland 100-day grain-fed steer over-the-hooks indicator continued to trade at elevated levels, averaging 677c/kg carcase weight in the June quarter, 9pc above year-ago levels.

And against a backdrop of overall declining beef export volumes on account of lower supply, grain-fed exports jumped 8pc quarter-on-quarter, with Japan the largest customer.

Capacity

National feedlot utilisation is also now at 81pc, above the five-year June quarter average of 77pc.

Thomas Elders Markets points out that Queensland, which holds the most cattle on feed in the country at 60pc, also dominates the capacity utilisation ratio with feedlots sitting at 85pc capacity.

Given the general shortage of cattle, that points to exceptionally strong confidence in the sector, TEM's Matt Dalgleish said.

Australian Lot Feeders Association president Bryce Camm pointed to the production certainty the sector provides brand owners and supply chains as underpinning that confidence.

"The fundamental driver is the desire of supply chains to provide consistent quality and supply to their customers 24 hours, 365 days a year, and feedlots facilitate this by providing production certainty in what is otherwise currently an unpredictable market," he said.

Keith Howe, managing director at big New England lot feeding operation Rangers Valley, said despite the tenuous position of paying sky high prices for stock with no way of knowing where the finished cattle market would sit at the other end, there was an underlying sense of optimism in lotfeeding at the moment.

Rangers Valley supplies premium marbled black Angus and Wagyu domestically and internationally,

"Demand for our branded products around the world remains strong and our challenge is to continue to maintain cattle intakes - we are definitely having to work harder than ever to do that," he said.

"Many of our key markets are rebounding strongly post-COVID, as food service comes back online."

It was expected the growth in the retail proportion of grain-fed beef markets would remain stronger permanently post-COVID, he said.

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.