Occasionally month-to-month export flows to countries like China, that take both lamb and mutton from Australia, show some signs of substitution.

Export trade figures from April to May show that for China, lamb volumes increased 10.6 per cent while mutton exports declined 31pc.

Across all trade destinations for the April to May period, the total volume of lamb exports increased by 1999 tonnes swt while mutton exports declined by 2291 tonnes swt.

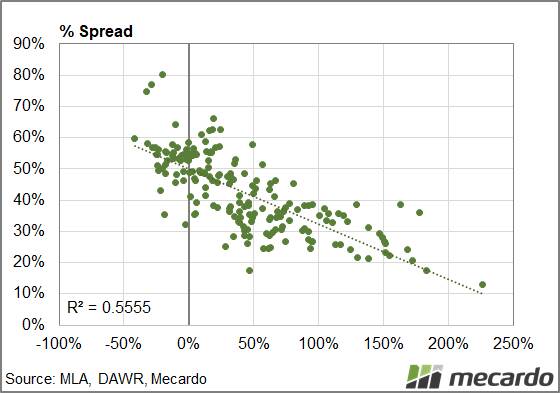

It begged the question - is there a relationship between the price differential between lamb and mutton and relative trade volumes?

Since 2004, when the percentage spread premium of the Eastern States Trade Lamb Indicator (ESTLI) over the National Mutton Indicator (NMI) exceeded 50pc, lamb export volumes could not get beyond 50pc more than mutton export volumes.

Similarly, when the percentage spread premium dipped below 30pc lamb export volumes expanded to close to double mutton export volumes.

When the price spread between lamb and mutton is high, signalling relatively expensive lamb, the trade flows favour mutton and in relative terms, lamb exports weaken (Figure 1).

When the spread is lower (relatively cheaper lamb) the trade flows favour lamb and lamb export volumes are relatively higher.

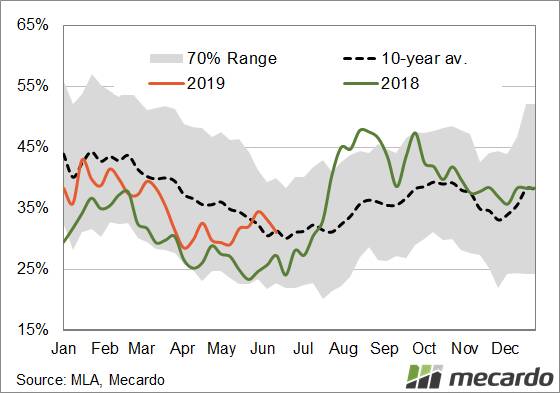

Since January this year, the percentage price spread premium between the ESTLI and NMI has been broadly following its normal seasonal pattern of narrowing.

It has drifted from a high of 43pc in January to a low of 28pc over April (Figure 2).

What does it mean?

Given the current low flock numbers and historically high prices encouraging increased production/flock rebuilding as soon as climatic conditions allow, there is a reasonable chance that we will see price spreads between the ESTLI and NMI remain toward the lower end of the normal range in the coming seasons.

This will be particularly evident when the flock rebuild is able to get underway in earnest and it provides a promising outlook for lamb exporters and producers, with lambs that meet the export specifications as the trade flows will favour lamb.