AFTER a disappointing run of seasons, Australia’s barley sector is proving to be the star performer in terms of pricing at present.

Nick Crundall, Market Check manager of strategy and managed programs said barley prices were a whopping $60 a tonne higher at a local level compared with the same time last year.

As usual, demand from the world’s largest buyer of grain, China, has been a major factor in the rally.

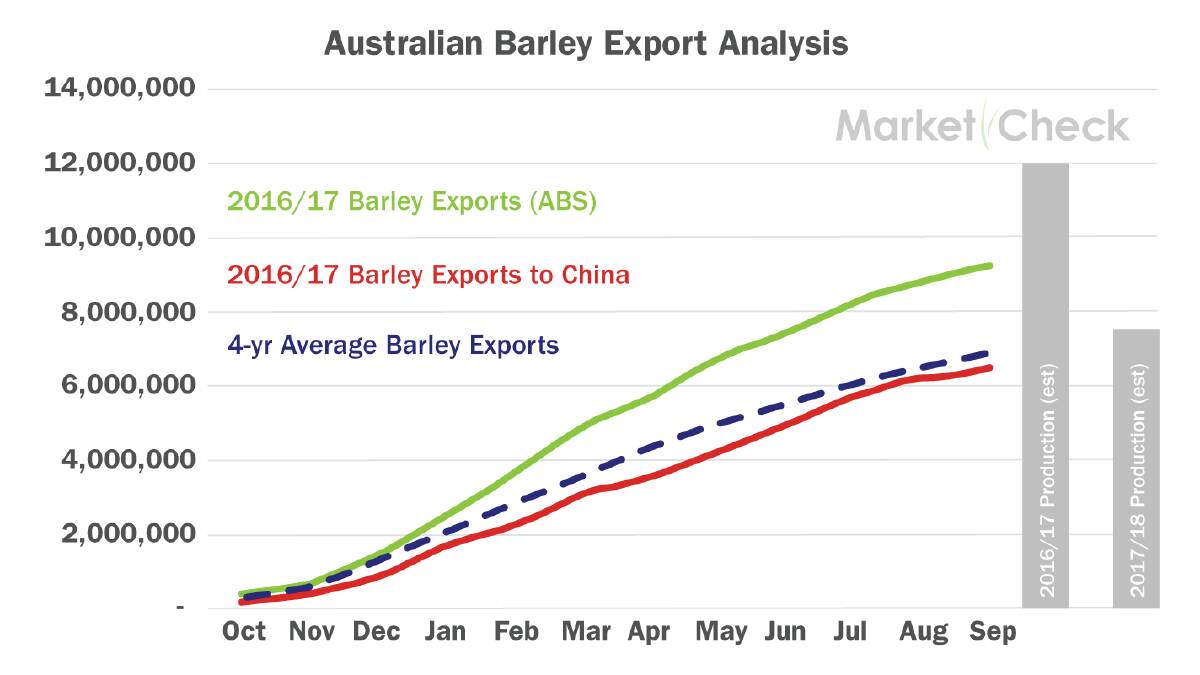

Mr Crundall said China took advantage of the cheap prices and abundant tonnages available last year, taking 65 per cent (6.2 million tonnes) of our record barley export program.

But in good news for Australian barley growers, this demand has not dried up in line with appreciating prices and a tightening balance sheet, meaning competition for barley is now strong between the export and domestic markets.

Mr Crundall said China was still chasing Aussie barley due to its quality, which means it can be used for malting, and high Chinese corn prices, meaning it was affordable for stockfeed purposes.

He said the tight world global balance sheet meant China was also happy to keep buying while stocks are readily available.

As a result, Mr Crundall said there had been strong forward sales into China.

“We’ve already booked around 2-3m tonnes of barley into China alone for 2017/18 which is a strong start to the export program<’ he said.

However, he said a lack of supply would eventually halt the export program.

“Unfortunately for China, we don’t have anything like the exportable surplus we did last season, which means that our price is going to have to continue to rally to ensure we don’t export too much that our domestic market is left hanging,” he said.

It is a welcome tonic for those who stuck fast with barley in their rotations this year.

Barley plantings were well down year on year, with the sour taste of the extremely low 16-17 prices meaning many farmers looked to other cereal crop options.

The low plantings exacerbated the dip in production caused by a decline in average yields from the 16-17 bin buster.

Aussie farmers were not the only ones to move away from barley this year.

Mr Crundall said globally there had been lower plantings and lower production of barley.

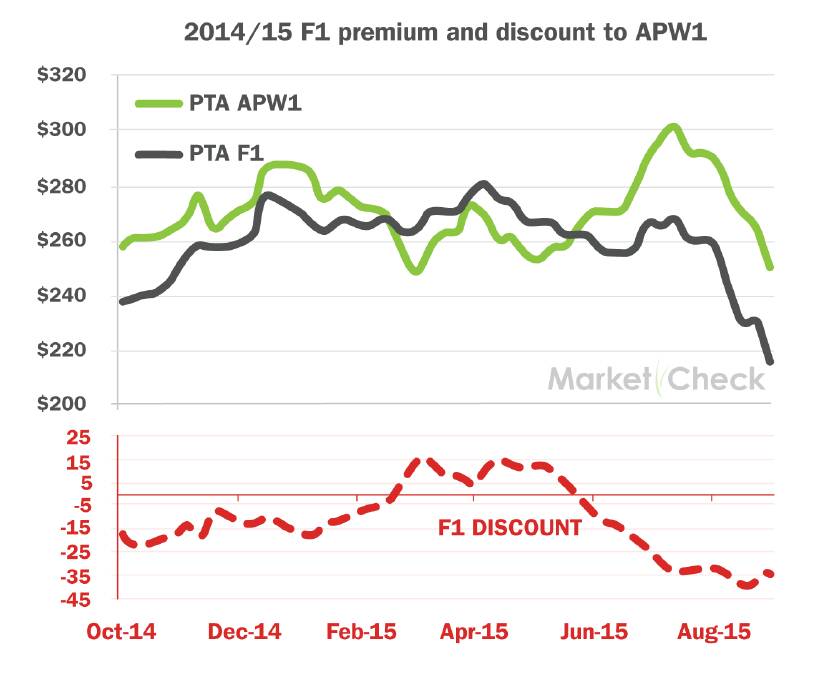

He said the current rally in Australian prices was the best since a similar China-based spike in 2014-15.

That season, F1 prices were up to $15/t higher than APW wheat prices in South Australia, but a regulatory change in China stifled Chinese demand, sending F1 down to $60-70/t below APW, where it stayed for some time.

Feed barley prices are currently around $225/t in South Australia, where the focus is on the export market, ranging up to $280/t on the Darling Downs, where domestic users are trying to attract tonnage.